A Biased View of USDA Rural Development Announces Top Guaranteed Rural

The smart Trick of Nevada USDA Loans - Find NV USDA Approved Lenders That Nobody is Discussing

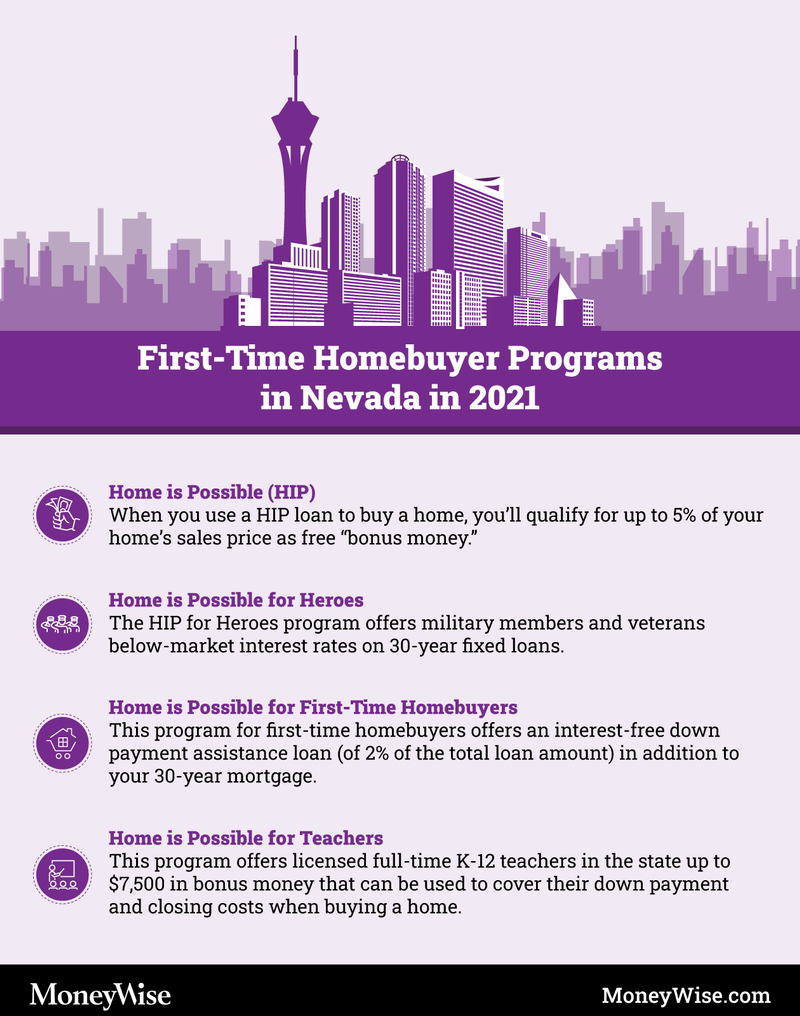

You should likewise have an income listed below $105,000; meet credit minimums (660 for an FHA loan and 640 for a VA or USDA loan); pay a one-time cost of $755 on the very first home loan; reside in the home as your primary house; and take a homebuyer education course. Did you see this? is $548,250.

Usda home loans help rural nevadans find their way home

NHD Hero to Home Program, The Hero to Home Program through the NHD is created to assist newbie homebuyers who have served in the military purchase a house. Through this program, you can get a 30-year loan at a below-market rate, which can be combined with another deposit help program if needed.

USDA Recognition 11-18-16

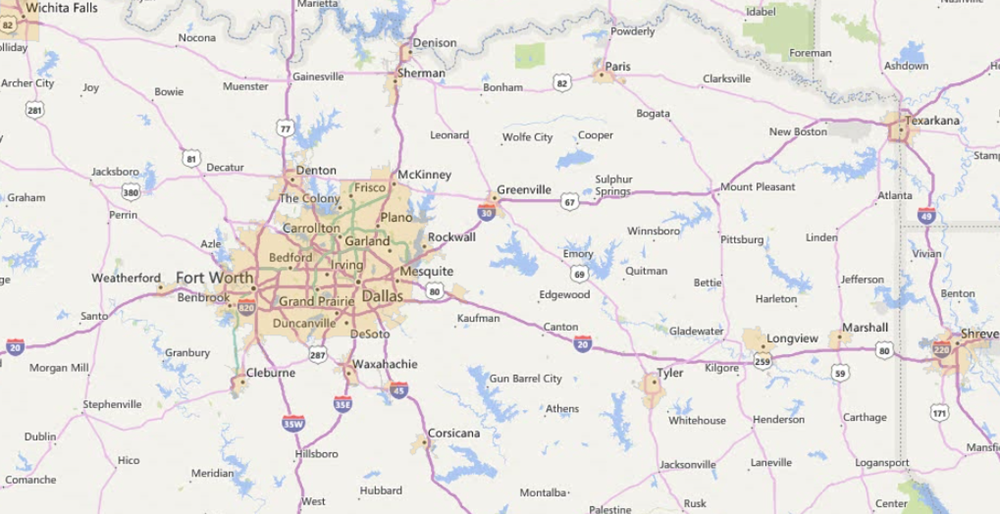

Food deserts in the Las Vegas metropolitan area, 2012 ( USDA ERS, 2012b) - Download Scientific Diagram

The smart Trick of Nevada County, California FHA, VA, and USDA Loan That Nobody is Discussing

Earnings limitations and credit rating requirements are based on the loan item chosen, either a 30-year, fixed-rate standard, FHA, VA or USDA loan. There are no purchase rate limits for this program, though the mortgage lending institution can set their own limit. You do not require to be a newbie homebuyer to be eligible, but you need to finish a free online education course and work with a getting involved lending institution to qualify.